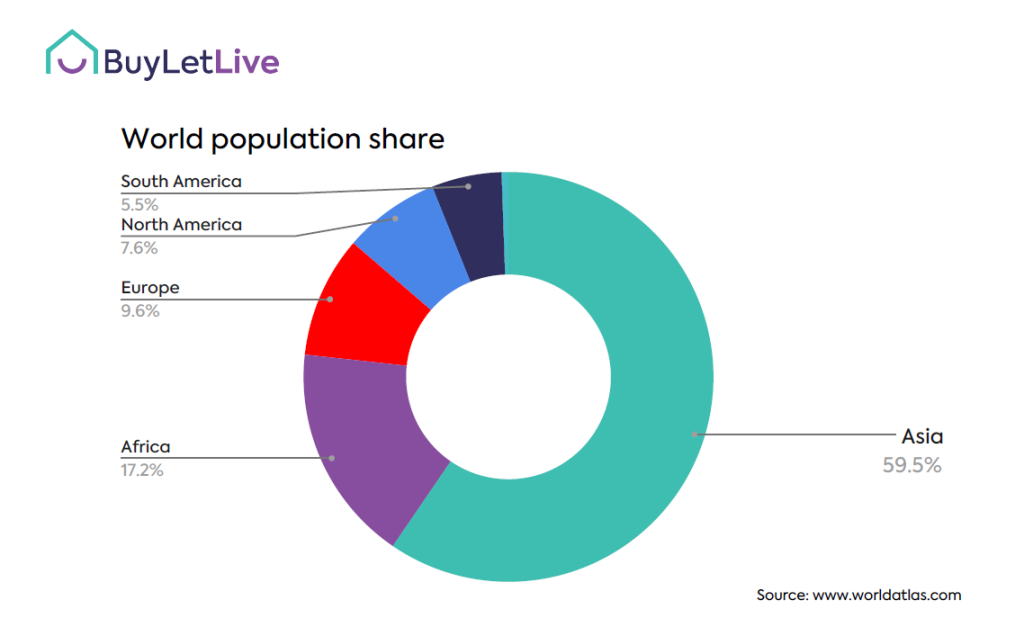

Gold, Diamonds, Crude Oil and People with a variety of other valuable natural resources are what you will find in abundance across Africa. Botswana and The Democratic Republic of Congo for instance are the world’s 2nd and 3rd largest miners of silver after Russia. With a population of over 1.4 billion people, Africa is the second largest continent in the world after Asia, both by population and land mass. When you compare the continent to other continents across the world, especially in terms of resource endowment, you will find very close matches. As one would expect, this should naturally translate to massive economic growth, especially in sectors like real estate where population numbers (demand) and the presence of certain natural endowments determine the size of market opportunities.

But what we find is the converse. Africa historically has not enjoyed the full potential of these resources. The result is a continent functioning below its revenue and growth potential across markets, and real estate is of particular interest in this piece. Despite its potential, the continent of Africa with its 54 member countries, is the least developed in the Third World. Although some sectors particularly Financial Technology have seen significant growth over the past decade, real estate has not gained similar growth compared to other continents across the world.

Africa’s development indicators are trailing towards a negative territory

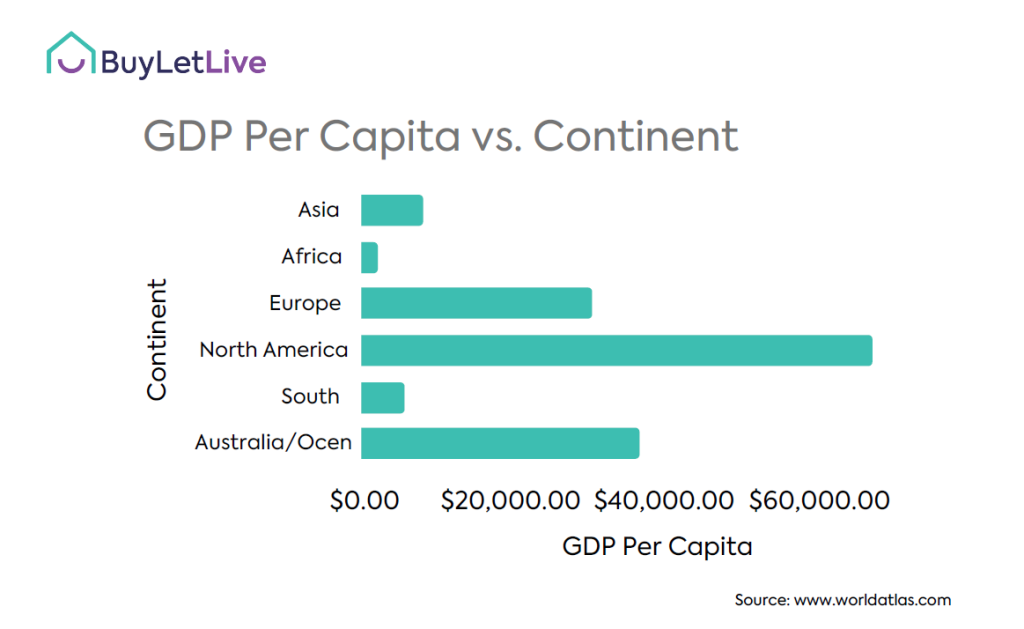

African development indicators have consistently trailed behind those of the third world since the late 90s. For instance, in 1997, Asia had a GDP per capita of $730, Latin America had $4,230, and Africa had $560. In contrast to Latin America, where economic growth rates in the 1970s were between 6% and 7%, Africa experienced economic growth rates of approximately 4% to 5%. Real GNP per capita on the continent fell by 0.7% between 1986 and 1993, whereas the Third World average rose by 2.7%. Real income per capita for the entire continent of Africa to date, has fallen by 14.6% from its level in 1965, leaving the majority of Africans in a worse financial situation than they were in 1965. When you get even more granular, the potential within Africa’s real estate market is far from tapped.

Africa’s real estate performance pales in comparison to other regions of the world.

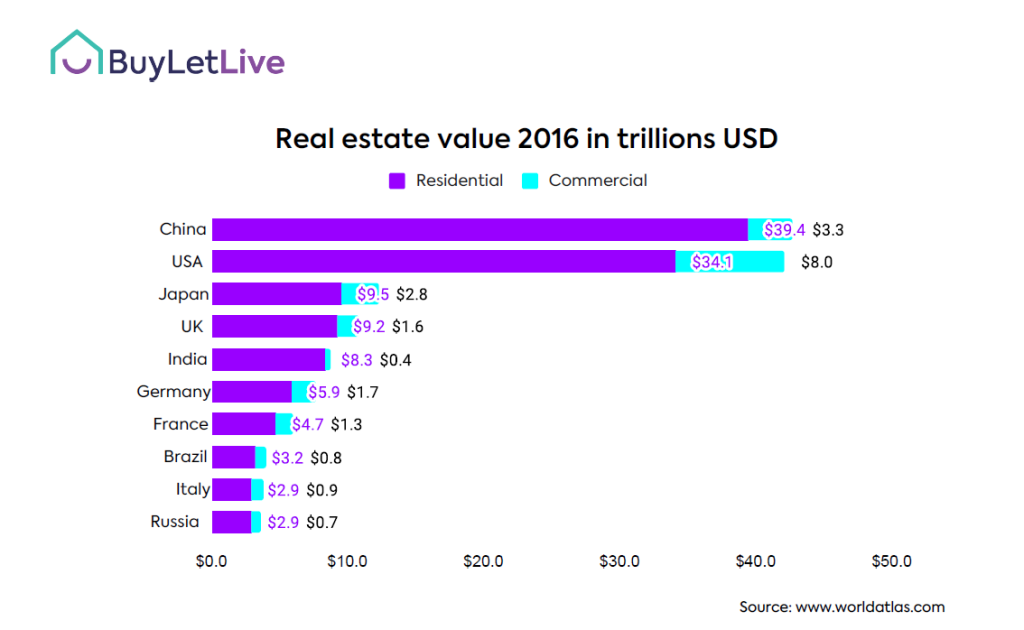

According to research by Savills, the value of all the world’s real estate reached $326.5 trillion in 2020, this represents a 5% increase on 2019 levels. To date, residential real estate accounts for 79% of all global real estate value. According to the same research, only 10 countries in the world control 70% ($141.5tn) of all global commercial and residential real estate value (totalling $200tn). China and the US together make up 42% ($84.8tn) of global real property value alone. China is home to more of the world’s real estate market assets (by value) than any other country at $42.7tn or 21% of global real estate value, just ahead of the US at $42.1tn. Japan, the UK, India, Germany, France, Brazil, Italy and Russia round off the top 10, between them accounting for 28%, or $56.8tn, of the global real estate asset total. Despite being the 2nd largest continent by landmass and population, no African country falls within the top 10 most valuable real estate markets across the world.

Infrastructure! Infrastructure !! Infrastructure !!!

Historically, low investment in Africa’s infrastructure has continued to hamper development activity. This has had a negative effect on the growth recorded across the continent, especially for the real estate sector. Quality investment does not only directly affect investor decision to buy real estate, but it also impacts the overall economic outlook. Real estate market development is more of an infrastructure game than population. While Africa’s population numbers are very attractive, the shortfall in infrastructure development has proven to be a major setback that has hindered investment in other sectors that could help grow real estate, including the value of output per person within the continent.

Excessive focus on the traditional asset classes

In most African cities, emerging asset classes like Student housing, healthcare and logistics have been grossly relegated. Investors have focused heavily on traditional assets like hotels, malls, offices, residential and in recent times warehouse/logistics asset class. As a part of the reaction to the disruption caused by the pandemic, more businesses have taken their operations online and internet access has become more essential than ever for business continuity. This reaction is continuing to stimulate demand for data centre development in Africa, with supply growing rapidly across the continent. According to DCByte, the major data centre additions in 2021 were in Johannesburg, Lagos and Nairobi. These locations, together with Cairo and Casablanca, are regarded as being the top five key data centre markets in Africa. The concentration of real estate investment in select asset classes across the continent needs to change in order to spur sustainable growth across Africa’s real estate market. Looking ahead, Africa requires deliberate, concerted and intensified investment in other asset classes including data centre demand as the need for connectivity by the public sector, and professionals in the fintech and healthcare space spur demand across the continent.

Macroeconomic events across the continent appear to hamper development

It continues to be difficult to attract significant amounts of institutional capital to Africa, and recent global macroeconomic events seem to make things even more difficult. In fact, the total cross-border investment in commercial real estate in Africa in 2021 was US$ 274 million, a reduction of 49% from 2020 and a reduction of 54% from 2019 numbers. This is largely due to political and socio-economic issues such as political instability, inflation, corruption, poor governance and other issues that have continued to threaten the continent in general.

Let us know why Africa’s real estate market has remained underdeveloped by sending an email to research@buyletlive.com. You can also join the conversation on LinkedIn and Instagram.