On the 26th of October 2022, the Central Bank of Nigeria announced the redesign of the top 3 denominations of the naira notes. According to plans, the ₦1,000, ₦500 and ₦200 notes were slated to be redesigned and swapped with the old notes. According to the Central Bank, this policy change was aimed at arresting some of the country’s most pressing economic challenges including currency fraud and inflation. Many have argued that this policy will shed some positive light on the economy but it however is accompanied by a myriad of impacts on specific segments of the economy and we want to zoom our lens, particularly on real estate. Before we dive in, here are some of the most recent CBN policy changes.

Key Decisions of the Central Bank of Nigeria Monetary Policy Committee November 21 and 22, 2022.

At the 288th meeting of the Monetary Policy Committee of the Central Bank of Nigeria, the Committee decided to:

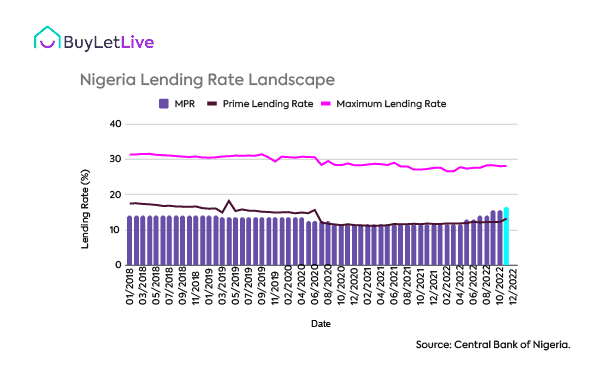

● Raise the Monetary Policy Rate to 16.5 per cent;

● Retain the asymmetric corridor of +100/-700 basis points around the MPR;

● Retain the CRR at 32.5 per cent; and

● Retain the Liquidity Ratio at 30 per cent.

In addition to these changes, the Central Bank also reviewed withdrawal limits for both individuals and corporates. For instance, on December 6 the apex bank announced a new policy limiting over-the-counter cash withdrawals by individuals and business entities to N100,000 and N500,000, respectively, per week. This was prior to the introduction of the redesigned naira notes. Following public criticism over the policy, however, the National Assembly ordered the bank to significantly increase the withdrawal restrictions, which led to the upward review which now permits individuals to withdraw up to N500,000 weekly and organizations to take N5 million weekly. Before we dive deeper, here is an explanation of some of the terms above.

MPR is a baseline interest rate upon which all other interest rates within the economy are predicted. In essence, MPR is the interest rate that the Central Bank will lend money to banks. Around the MPR is the symmetric/asymmetric corridor. It caps the lower bound rate at which excess reserves are expected to be deposited with the Central Bank and the upper bound rate at which banks can borrow from the Central Bank. With market participants interacting to ensure that money market rates cycle around these corridors, the MPR and the corridor are intended to direct short-term interbank prices around the MPR. The Cash Reserve Ratio (CRR) is the percentage of total deposits a bank must have in cash to operate risk-free. In this case, the CBN capped it at 32.5% of the bank’s total deposits by customers.

Interest rate hikes and naira scarcity is likely to cause a recession and can potentially fuel a crash in supply in the property market.[LA2] In the context of the new CBN policies, a cash withdrawal and money transfer limit policy can effectively have both direct and indirect impacts on real estate market transactions and development activities. On the transaction side, here are some of the direct and indirect effects.

Direct Effect:

Reduced black money transactions: The limit policy may help to reduce the use of black money in the real estate market. This is because cash is often used to facilitate transactions in the black market, and limits on cash withdrawals and money transfers can make it more difficult for individuals to engage in such activities. This can potentially lead to a decrease in demand for high-end properties that are often purchased with cash.

Indirect Effects:

Impact on liquidity: Reduced cash transactions can have an impact on the liquidity of the real estate market. If buyers are unable to make cash purchases, they may be forced to rely on bank financing, which can be more difficult to obtain, particularly with interest rates being high or lending standards tight. This can potentially lead to a decrease in demand for high-end properties.

Impact on property prices: Reduced demand for high-end properties can lead to a decrease in property prices. This can potentially lead to a decline in the overall value of the real estate market. Additionally, if the policy leads to a reduction in black money transactions, it can also reduce demand for high-end properties, which can further impact property prices.

The impact of cash withdrawal limits on real estate development activities will depend on several factors, including the magnitude of the withdrawal limit, the current state of the real estate market, and the specific dynamics of the local economy. However, in general, a lower cash withdrawal limit could potentially have several effects on the real estate development sector, including:

Reduced liquidity: If the cash withdrawal limit is too low, it could restrict the flow of cash in the economy and reduce the liquidity available for real estate development activities. This could make it harder for developers to secure the necessary financing and investments to fund their projects.

Increased transparency: A lower cash withdrawal limit could force developers in Nigeria to rely more on formal banking channels, which can increase transparency in the real estate market. This could lead to greater scrutiny of real estate transactions and help to reduce corruption and illegal activities.

Impact on demand: If the withdrawal limit is significantly lower than the current threshold, it could affect the demand for high-end and luxury properties that are typically purchased with cash. This could lead to a slowdown in the real estate market, particularly in areas like Ikoyi, Victoria Island and Banana Island where luxury developments are prevalent.

Innovation and adoption of digital payments: A lower cash withdrawal limit may force developers and investors to explore new and innovative ways of transacting, such as digital payments or other cashless options. This could lead to the adoption of new technologies that could make real estate development more efficient and cost-effective.

In conclusion, the impact of cash withdrawal limits on real estate transactions and development activities is not straightforward and will depend on a variety of factors, including the extent of the policy, the existing state of the real estate market, and a number of local market nuances. However, it is possible that a lower withdrawal limit could have both growth and limiting effects on the real estate market, depending on how it is implemented and enforced.

Let us know how you think the new CBN policy will impact the real estate market in Nigeria by sending an email to research@buyletlive.com. You can also join the conversation on LinkedIn and Instagram.