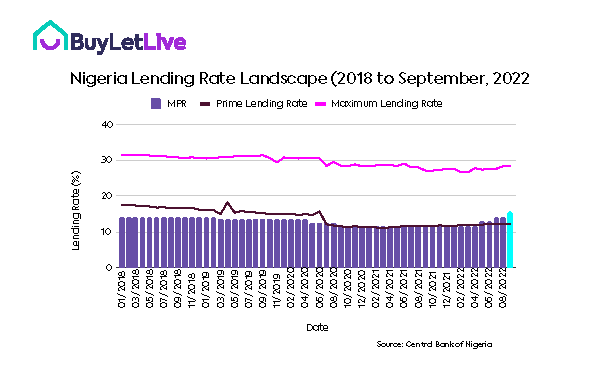

In September 2022, the Federal Government of Nigeria revised the national lending rate by 150 basis points from 14% to 15.5% in an aggressive move to curb inflation in the country. You will recall that earlier in the year, in July specifically, the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) had raised the benchmark interest rate from 13% to 14%.

One of the top reasons for raising the benchmark interest rate, according to the Central Bank Governor, Godwin Emefilele, was to absorb the excess cash that was in circulation. That is, to make the cost of funds expensive to drive down inflation. So far, this has been the largest baseline rate in the country, and like many other sectors, we are wondering how this will affect the performance of the real estate market in Nigeria, especially with regard to mortgages. We took a close look at how this review will likely affect mortgage penetration in Nigeria and the real estate market in general. Here are our three key expectations:

Lower mortgage penetration in the coming quarters

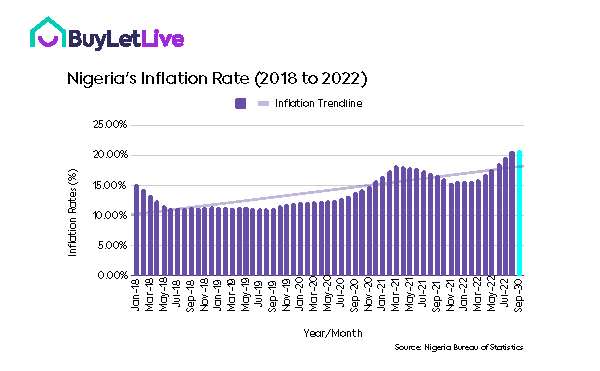

In 2019, the Central Bank of Nigeria developed a legal and regulatory framework for the mortgage industry in Nigeria. One of the biggest challenges facing the Nigerian mortgage system from a supply-side perspective, as highlighted in the report, is high interest rates. At the time, the monetary policy rate (MPR) in Nigeria was 13.5%, with a less than 10% mortgage penetration rate. Although the Federal Government, through its agencies, has made concerted efforts to improve access to mortgages, interest rates still play a huge role in most mortgage-related decisions. With inflation hovering around the 20% region, prospective mortgagors are finding it harder to save up the equity contribution required by the mortgage banks as part of the approval requirement. In our opinion, the additional interest rate pressure on mortgages means that fewer people will opt for mortgages when buying a home. The impact of this would be a further reduction in the mortgage penetration rate across the country.

Stall in project completions and possible revision of existing construction contracts

2020 marked the beginning of a difficult time for developers in Nigeria. Restrictions in the global supply chain meant delays in the completion timeline for a number of projects that were under construction across the country. With the hike in MPR and the rising cost of items, especially building materials, we expect that more projects may be stalled further.

As of September 2022, the inflation rate in Nigeria stands at 20.77%. With the rising rate of construction materials, we expect to see more contractors calling for a review of their construction contracts in line with the prevailing market circumstances. This may present a worrying outlook for a number of property sub-sectors in Nigeria, including the residential sector, where there is a gross undersupply across the country.

Higher rental and sales prices of properties

Earlier in the year, in June specifically, we analyzed 5,000 properties that had been posted on BuyLetLive.com over the past 12 months and across different locations in Lagos. One interesting fact that we noted was a 24% YoY growth in the price of properties that are available for purchase in Lagos. In some locations, the average price of properties listed on our platform almost doubled. As lending rates increase, houses will become more expensive. This is because the cost of servicing debts will rise, and developers will charge more for their completed projects in a bid to cover their costs.

Let us know how you think the hike in MPR will affect the property market in Nigeria by sending an email to research@buyletlive.com. You can also join the conversation on LinkedIn and Instagram.