In 2023, Nigeria saw the highest devaluation in the Naira and the steepest spike in interest rates in its history. These fluctuations have a significant impact on various segments of the real estate market, particularly the residential sub-market. One of the most profound impacts on residential occupiers has been the surge in house prices especially across key cities like Lagos and Abuja. With income remaining static for most people, Lagos residents have been forced to devise creative ways of navigating the rise in apartment prices. Some of the most popular have been the flight-to-rent financing alternatives that help bring the typical annual cost to a monthly equivalent. This, of course, comes at a cost but is more bearable when paid in installments. In this article, we will be diving deeper into the intricacies to uncover the extent to which inflation, rising interest, and foreign exchange rates are affecting residential tenants in Lagos. Before we dive in, let’s see how FX, inflation, and interest rates have trended historically.

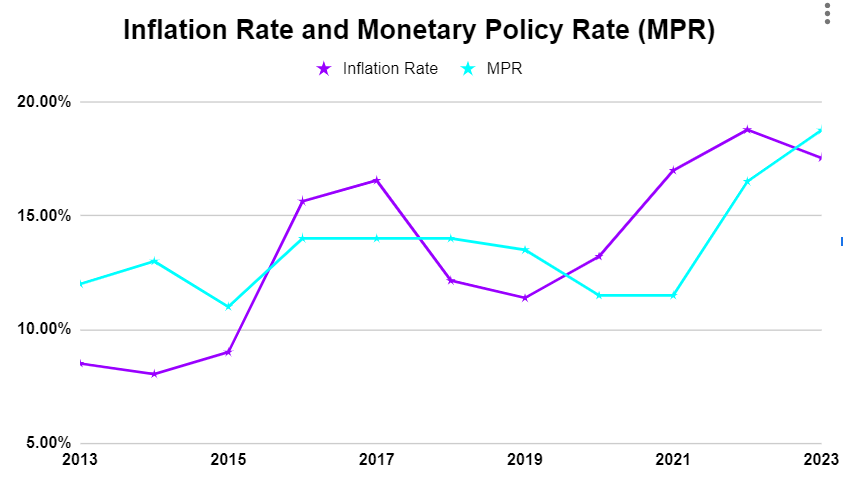

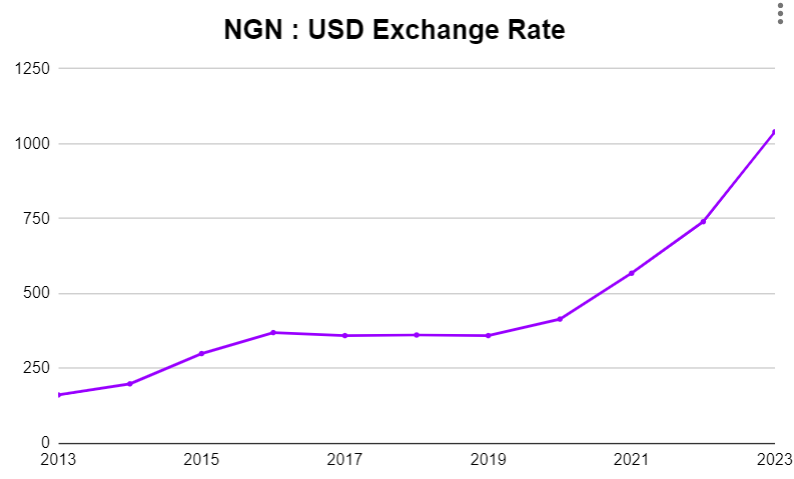

The Central Bank of Nigeria (CBN) has been raising interest rates to combat inflation. This has made it more expensive for people to borrow money to buy homes, and this has led to a decline in effective demand for houses. The foreign exchange market has also been volatile in recent years, with the Naira losing value against the US dollar. Because Nigeria’s construction sector is heavily dependent on imports, foreign exchange volatilities have made it more expensive for Nigerians to import building materials, which has led to an increase in construction costs. Upon completion of construction projects, these costs are usually passed down to the end users. In the following paragraphs, we assess these impacts on residential tenants in Lagos.

Flight to premium-type residential developments as developers strive to earn more profits

Construction costs are rising. Borrowing related costs, alongside the generally high cost of acquiring land for development makes it almost impossible for developers to sell at affordable prices. The goal of every capitalist is to profit from the capital and manpower deployed in any venture. As costs continue to rise, developers are shifting their focus from building middle-income homes to deluxe and luxury projects where there is more room to charge a premium and recover costs.

Growing renter market as high borrowing costs deter potential buyers from owning homes

Rising interest rates make borrowing more expensive. Between 2018 and 2023, the Monetary Policy Rate in Nigeria increased from 14% in Jan 2018 to 18.75% in September 2023. Among many other impacts on the overall economy, these increases have deterred potential home buyers and reduced effective demand for housing. For homeowners with active mortgages, the increase in the cost of borrowing has led to increases in monthly mortgage payments, making it more difficult to afford a home. This could disproportionately impact low-income households and further limit access to homeownership.

Delay in construction activity leading to a surge in the price of new projects

Exchange rate fluctuations have significantly affected the cost of imported construction materials. Due to the excessive dependence of Nigeria’s construction market on imported products, this has resulted in increased construction costs for developers. For many developers, this has led to delays in construction activities. Exchange rate fluctuations have also affected investment decisions in the real estate market. As the naira continues to depreciate, foreign investors may be reluctant to invest in real estate in Nigeria. The impact of this may be a decline in investment activity especially within the luxury and ultra-luxury segments. One of the impacts will likely be a further slowdown in sales transactions. Because of Lagos’ high population, there will likely be no tangible impact on the rental side of the market as people will continue to need accommodation.

Overall, there is a high interconnectedness of the Nigerian residential real estate market with the broader economy. Factors such as inflation, exchange rate, and lending rate, usually have a direct impact on the performance of the real estate market. Changes in interest rates and foreign exchange rates can have significant ripple effects throughout the market, affecting demand, affordability, construction, investment, and overall market sentiment. The CBN is expected to continue raising interest rates in the near term, which will continue to dampen demand. However, the government is also taking steps to boost the economy, which could lead to an increase in demand in the longer term.

We love to hear your thoughts. Send us an email to research@buyletlive.com and we will be in touch.